Where does your food brand sit on the Challenger Matrix?

by Jono Wylie

Okay, time for round two.

We spoke in my last article about a few things. About how big fish food brands like Doritos, Silk, Ocean Spray or Häagen Dazs don’t look so big when compared to the megaliths of Walmart, Kroger, Tesco or Publix. And about how those grocery stores are getting better and better at making copycat products – which, according to 2024 data, are increasingly being chosen by consumers over the big brands.

So in this article, it’s time to get specific: you might be suitably freaked out by the threat of the private label ‘trawler net’ that’s indiscriminately hoovering up everything it can see and feeding it back to consumers at a cheaper price that you could never compete with. But what exactly can you do about it?

It all comes down to mindset.

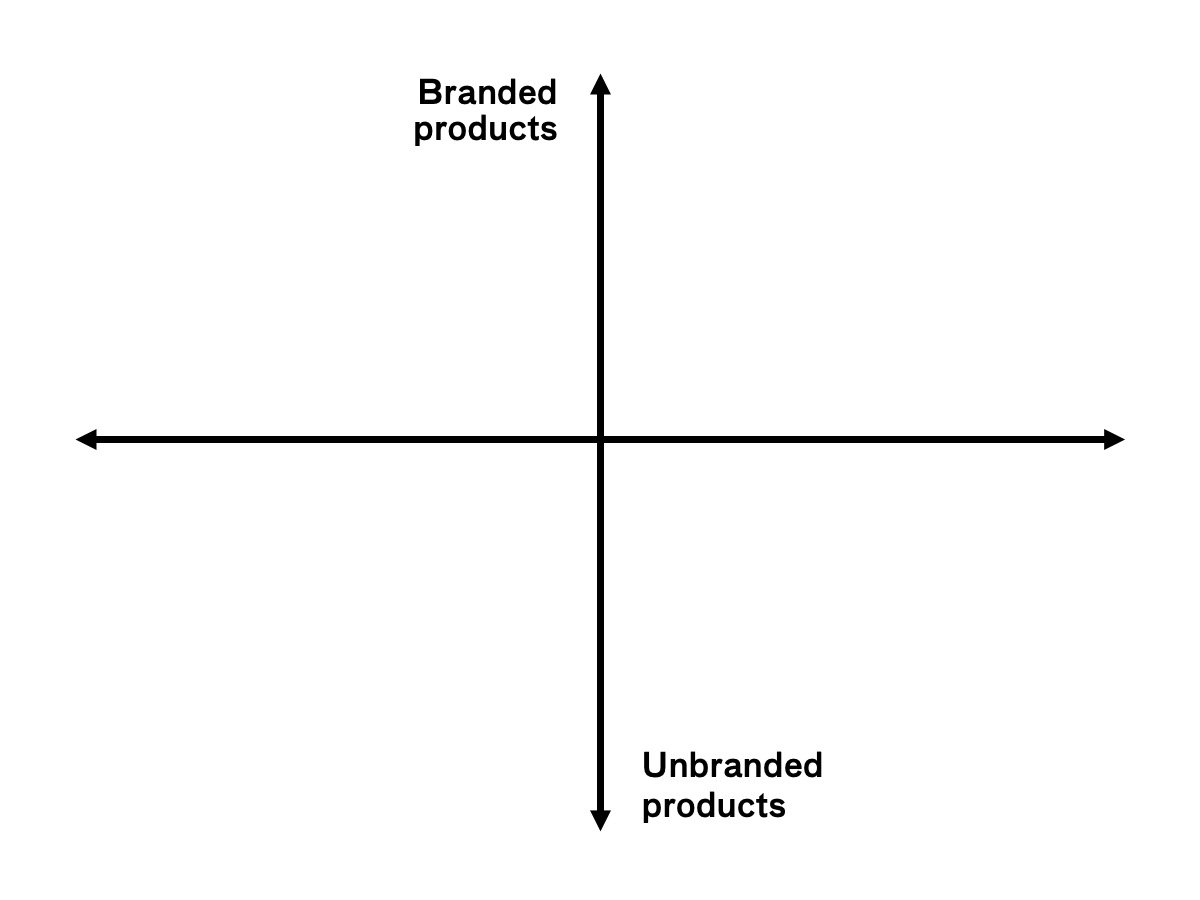

I’m going to employ the help of a handy matrix to make this point. (Yes, like a good little consultant, I’ve made a 2x2 matrix...)

On the Y axis (the up and down axis, for those of you who didn’t enjoy maths at school), we’ve got ‘branded products’ vs. ‘unbranded products’.

At the bottom are the private label products, who, by definition, don’t make a big deal of brand building for the individual SKUs. That’s not to say that a bag of Good & Gather tortilla chips or a jar of BetterGoods salsa isn’t the result of significant investment into marketing.

In fact, the design studio COLLINS recently helped Walmart with a beautiful and carefully considered brand launch for the BetterGoods line. The packaging is stunning and sympathetic to modern consumer habits. It’s just that, the individual SKUs don’t have their own brand personality. The ‘brand’ is the grocery store which produces them, not the chips or salsa themselves.

Pretty straightforward so far.

And at the top are the brands, that make a big deal of brand building for the individual SKUs.

Think Snickers, or Doritos, or Ben & Jerry’s, or Silk, or Orville Redenbacher’s, or Jack Link’s, or Planters peanuts. A hundred different products that stand for a hundred different emotional propositions, with a hundred different tone of voice guidelines and Super Bowl ads and social media strategies.

It’s worth clarifying that there are myriad ways of building brands: in the list I just mentioned, there might be some food brands that you think do a really good job of this, and others that feel too performance-driven, or too old-fashioned, or too serious. And that’s where the X axis comes in.

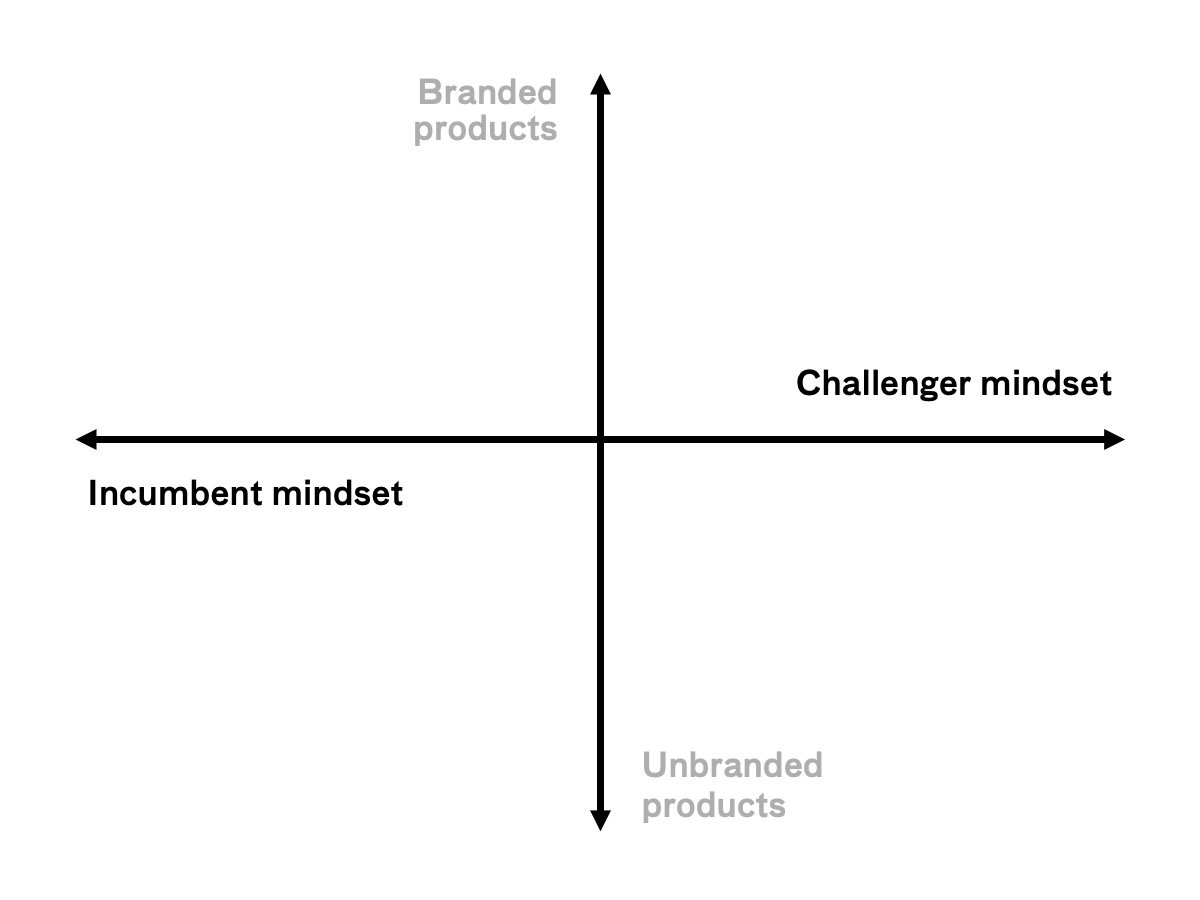

Because this is where we get into the mindset that the brands embody.

On the left, we’ve got the Incumbent Mindset. In short, the Incumbent Mindset is all about a couple of things:

Maintaining the status quo of the category and the way things are done

Only having ambitions that are equal in size to one’s resources (“want growth? Can’t do it without a bigger advertising budget”, or so says the Incumbent Mindset)

This mindset is rife in almost every boardroom in America. And often for understandable reasons. We love a precedent, don’t we? There’s a certain safety net that feels like it accompanies the status quo. And, of course, the status quo becomes the status quo because, at some point, it made sense. And as for insisting on more resources in order to match higher ambitions? That just sounds like good common sense, right?

Well, not so fast. Because on the right-hand side of the X axis is the Challenger Mindset. This mindset is the opposite: it insists on progressing not only your own business and the way you do things, but also the entire category: it seeks to create new criteria of choice, and to change the way that consumers navigate the category. Red Bull brilliantly did this in the world of soda, by creating an entirely new sub-category they could win in, which confounds Coca-Cola and Pepsi to this day. And more recently, Olipop and Poppi have been causing similar head-scratching at Coca-Cola towers. Or what about Tony’s Chocolonely, defying all the odds by breaking into a chocolate category that was seemingly dominated by incumbent players like Cadbury and Galaxy in the UK, and Hershey in the US, in a move echoing elements of Ben & Jerry’s successful rollout? These are brands which somehow managed to create outsize effects in the marketplace despite having ambitions that far outweighed their resources.

Note that we’re not talking about small Challenger brands here, necessarily. These examples range from cult favorites all the way up to household names, but they each embody that Challenger Mindset.

So where does your business fit on this 2x2 matrix? Let’s roll up our sleeves.

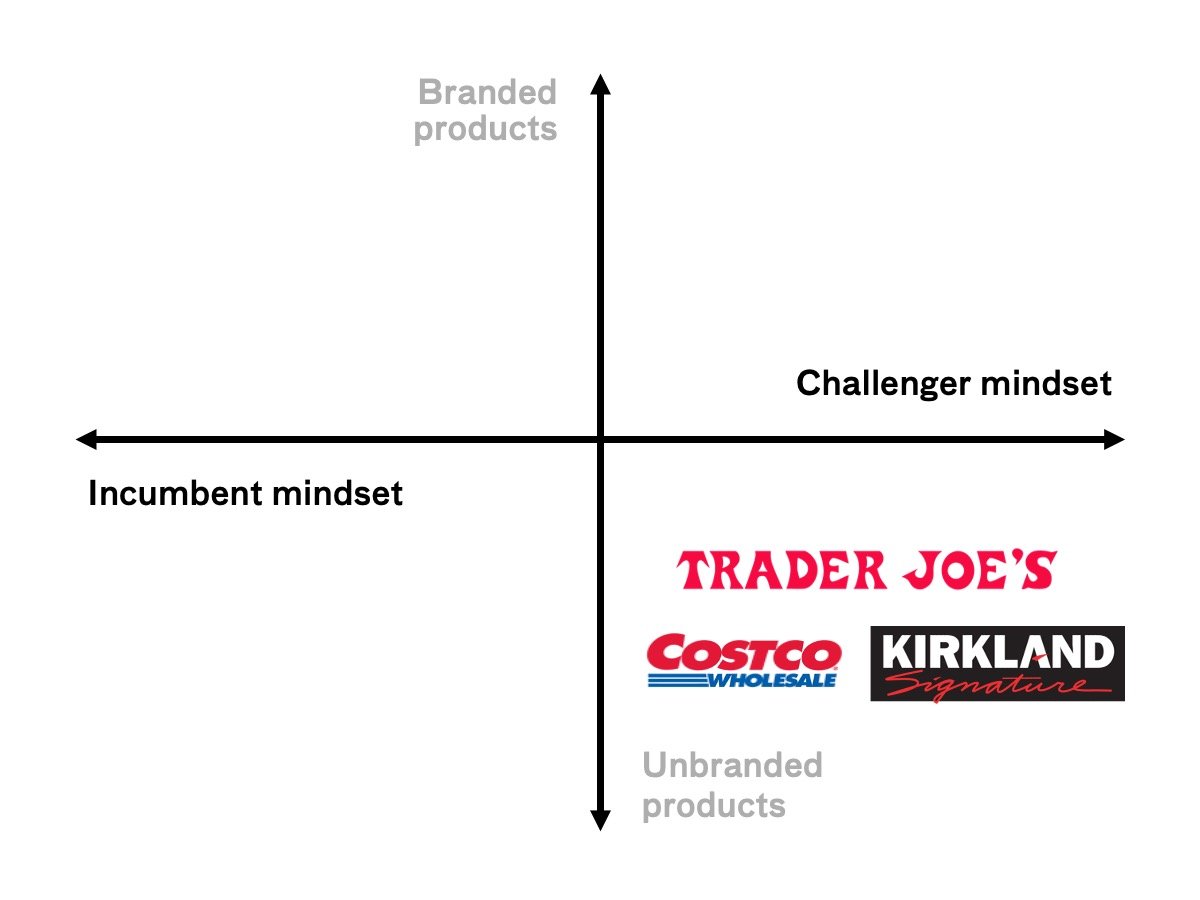

It might make sense, first of all, to eliminate those rare grocery stores that fit into the bottom right quadrant, for the purposes of this discussion.

Grocery stores that possess the mindset of a Challenger are rare, and it’s even rarer to see private label products themselves thinking like Challengers: progressing the category. Usually private label is all about reflecting the category. I think we can put brands like Trader Joe’s (a favorite of mine) and perhaps Costco, too, in this bottom right quadrant. Some of the product innovation you can find in Trader Joe’s items is all their own doing, changing consumer behavior and often driving the rest of the market to catch up. Similarly, certain Kirkland items develop a cult following and a life of their own. Much has been written about how these two grocery stores have disrupted and innovated, sometimes to an unhelpful extent: while they’re brilliant case studies, they’re quite unusual.

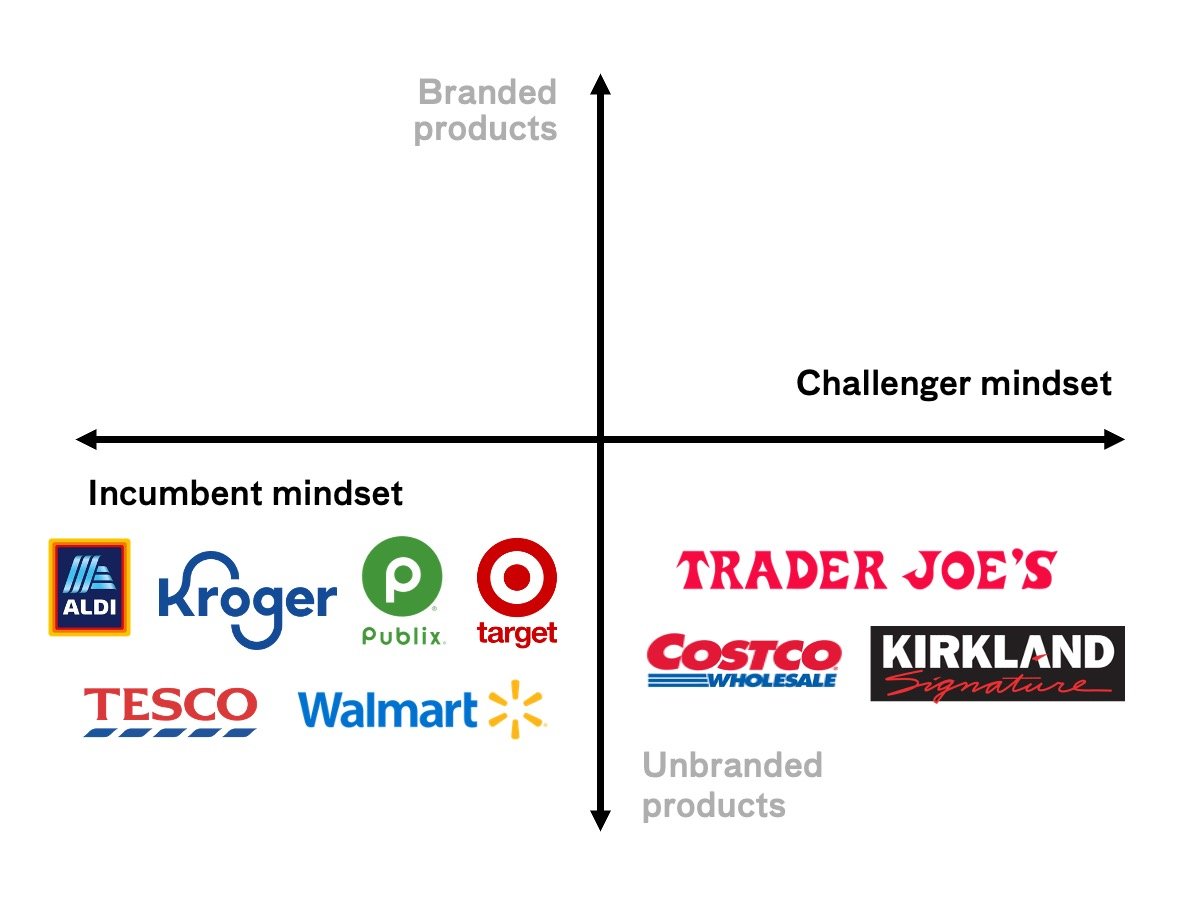

Because, for 99% of cases, the private label food boom that’s threatening food marketers can be placed squarely in the bottom left. Even innovative new private label lines launched by forward-thinking marketers at grocery stores like Walmart are opportunistically maintaining the category, and giving shoppers all the lovely new things they’ve come to expect from branded items, at that lower cost shoppers love. Things like truffle chips at Aldi for $1.50, and beautifully packaged chocolate coated almonds from Target that are just like the Blue Diamond brand, except with added Himalayan salt (fancy!)

The most vivid example of this is Aldi, with its egregious copyright dance that aims to get just as close as it can to imitating brand leaders without getting a lawsuit (or, in the case of Thatchers vs. Aldi, one step beyond). But for all of Aldi’s headlines, this is happening in every grocery store to varying degrees. The Incumbent Mindset works for them, because who needs to progress the category when you can just steal share from the more expensive brand leaders? And who needs to worry about resource deficits when you own the store you’re selling in, and can give beneficial shelf space to your own products without having to pay for the privilege?

Remember, this chart is not trying to suggest that the grocery stores themselves are Challengers or Incumbents. Many might call Aldi a formidable Challenger. We’re trying to look at the products themselves that are on the shelf.

On the top, then, is where the rubber hits the road for brand marketers.

I’m not going to call out any brands in particular in that top left spot: the Danger Zone. But I would invite you, as a marketer working at a big food brand, to ask yourself the hard question. If the Incumbent Mindset is ringing a bell with you, your choice is whether you’ll allow yourself to remain in that dangerous top left spot, and risk being caught by that private label trawler net. Or, will you decide to make a break for it, and give the Challenger mindset a try? Brands that do this are nimble and harder to copy, staying ahead of the trawler net in many different ways, allowing them to slip through the net when it tries to catch them.

In the next and final article on this subject, we’re going to look at some case studies of those top right examples: the branded products, both large and small, who adopt a Challenger Mindset. We’ll get specific about the ways in which they’re insulated from the private label copycats. And we’ll learn some transferrable lessons that you can take to your own brand planning processes.

Until then, here are three questions to ask yourself, to establish if your brand is in that top left spot:

If I’m honest, is my brand doing more to maintain the status quo? Or to progress it? Do we find ourselves playing defense more often than offense?

When I think about all the constraints I’m facing (budget, timings, new competitors, consumer trends), have I lowered my ambitions in the face of that? Or am I seeing them as opportunities?

So, where does my brand sit on the matrix?

We’ll see you next time. And as I leave you, putting on our best Finding Nemo voices from the previous article, let’s say together:

“Private label dupes of my product are the biggest existential threat facing my CPG food brand over the next few years. To survive, I must adopt a Challenger Mindset.”