“Fish are friends, not food”: Why big CPG food brands must think like Challengers

by Jono Wylie

Don’t turn around right now, but do you ever feel like someone’s sneaking up on you?

Or, more accurately, something?

This article, and the two that will follow in a three part mini-series I’m writing, is for marketers at food juggernauts like Jack Link’s, or Orville Redenbacher’s, or Planters, or Mars, and any number of ‘big fish’ food brands.

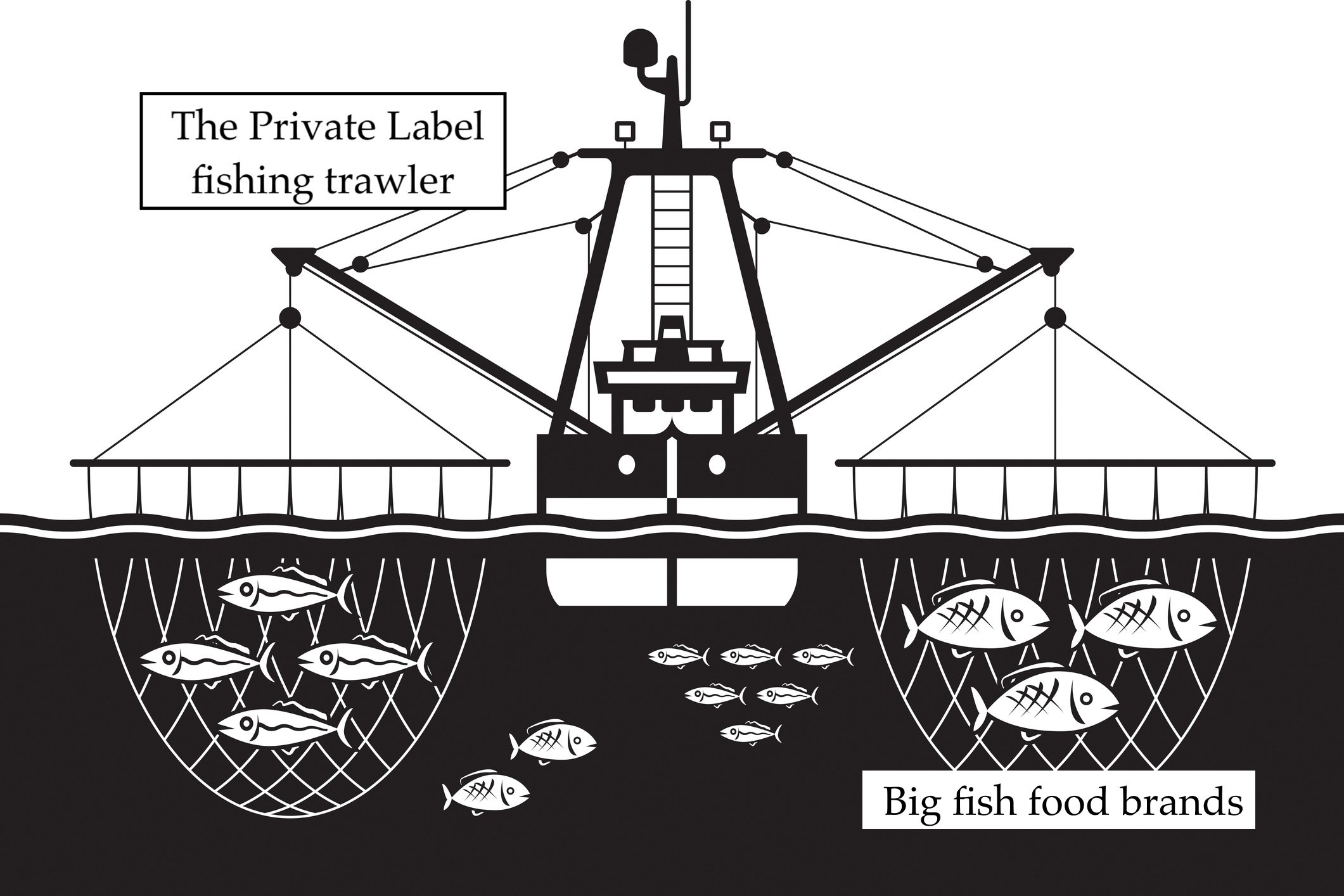

But the thing that’s behind you, Mr. or Ms. Big Fish, is not another fish at all. It’s more like a faceless trawler net scraping the ocean floor and catching everything in its path.

It might be behind you right now, about to tangle you up in its net.

And that trawler net is private label.

You’re a busy executive so I’ll give you a summary of my argument first. If you like what you see, stick around and I’ll unpack exactly what I mean.

Legacy CPG food brands like yours are the ‘big fish’ dominating the grocery market. You have come to represent the category norms. How does the ketchup category behave? Look at Heinz. What’s the vibe of the popcorn category? Look at Orville Redenbacher.

Private label is the ‘trawler net’ threatening your dominance with lower prices and growing quality. Beating you at your own game, much to consumers’ delight. Consumers don’t care: they’re getting most of what they loved about you, for less money.

Challenger brands, or ‘little fish’, escape the trawler net by thinking differently: by keeping a Challenger Mindset, that focuses on progressing the category, and creating a different criteria for choice. Private label brands copy Challengers less often, not just because their market share is lower, but also because they’re harder to copy.

Big fish must realize that little fish are often friends, not food: that they can learn from them and embrace their Challenger Mindset to avoid being caught by the private label net.

The Big Fish Problem:

I’ve spent the last few weeks speaking to marketers at CPG food brands, reading your publications, listening to your podcasts, browsing your Instacart pages and wandering the aisles that bear your products. The biggest thing I saw loud and clear was this:

Private label has had a glow up.

In every way:

Premium design and packaging.

Premium ingredients (Aldi sells truffle chips for $1.50 now).

Speed of innovation (Kroger was quick to jump on the keto diet trend; how many weeks will it be until they follow ConAgra and start putting GLP-1 labels on their private label ready meals?)

Multiple SKUs and even multiple different brands (Favorite Day, Market Pantry and Good & Gather are all Target private label lines, and Walmart added BetterGoods to sit alongside Great Value last year, their largest private brand food launch in 20 years).

Image: Walmart

They’re doing this while having a massive structural cost advantage. They own the damn store, for starters.

And their marketing budgets are massive, albeit advertising a master brand rather than specific products. Above the line advertising spend for Walmart and Target and Kroger vastly overshadows the marketing spend for specific big brands like Doritos or Silk or Ocean Spray or Häagen Dazs. Walmart spent more than $4 billion on advertising last year, six times the $605 million spent by Hershey’s.

Of course, that’s not an apples-to-apples comparison. Hershey’s is only advertising chocolate and confectionary, whereas Walmart is advertising an entire store. But that distinction matters a lot more to marketers than it does to consumers, who don’t see these distinctions. When in the cereal aisle, consumers have had a $4 billion firehose of advertising directed at them, building salience and memory structures, compared to a sixfold deficit for the Hershey chocolates. When you add in direct response spend and mailers, the disparity gets even bigger. Not to mention the massive logo on the wall of the grocery store, which is like a permanent billboard seen by everyone driving past every day.

Big fish brands don’t look so big when compared to grocery stores.

This isn’t particularly new, but the quality of private label products inside the stores is.

It wasn’t such a long time ago that I wouldn’t have dreamed of buying store brand chocolate, or store brand jerky, or tortilla chips – they would taste kind of funny. The big brands had proprietary recipes, and processes that were hard to replicate. But everything is becoming easier to emulate. The moats protecting most big food brands are drying up, and private label brands are capitalising on that.

It’s being reflected in consumer attitudes. More than half (55%) of US grocery shoppers have bought more private brand goods over the past year, compared to 28% who did so with name brands, according to FMI. This all adds up to private label’s market share exceeding 20% in the U.S. in 2024 and growing. The picture in Europe is no better. According to Statista, chips, snacks, cereals, cookies, candy and bread are the most at-risk categories. But this is likely to expand as consumers continue to see the breadth of alternatives on offer at a lower cost.

For food marketers, it’s exhausting. For 25 years, you’ve known that big fish do battle with little fish. But now there’s a third character to be reckoned with: the silent, wide, undiscriminating trawler net of store brands, scooping up all the equity you’ve built, and giving it to consumers at a lower cost. So, what on earth are you supposed to do about it?

The response from big food marketers often boils down to something like this:

“We’ll keep an eye on the Challengers in the space, and we might acquire one if the time is right. But for now, we need to pause on the creative stuff and just win the battle with private label by reducing our costs and staying competitive.”

I’m here to tell you that, while I entirely agree with the assessment of the threat of private label, Challengers need to not be ignored in the meantime. In fact, they might have something they can teach you, even if they are a lot smaller than you.

Yes, you got it. The Challenger Mindset.

In my next two articles, we’ll explore mindsets, and how it’s about more than size or penetration. We’ll learn lessons from Challengers small (including Bold Bean Co and Back to Nature) and Challengers big (like Ben & Jerry’s). We’ll talk about Netflix and how they use their Challenger Mindset to stay number one. And we’ll explore a handy little matrix that you can use to figure out where you stand.

And I’m giving all of this to you for free? You lucky things.

Stay tuned for more. And in the meantime, say it with me:

“Private label dupes of my product are the biggest existential threat facing my CPG food brand over the next few years. To survive, I must adopt a Challenger Mindset.”